Management Structure

As of February 28, 2023

Governance

Transparency, integrity, responsibility and adherence to the best corporate governance practices make up the governance system of Grupo Financiero BBVA México, which, together with ethical values and efficient management of financial and non-financial risks, guarantees the sustainability of the business in the long term.

Corporate Governance

BBVA México’s corporate governance system is made up of four key institutional principles:

The appropriate composition of its governing bodies

Clear delimitation of roles for the Board of Directors, its Committees and Senior Management

A sound decision-making process and a consolidated information model

A system of monitoring, supervision and control of management

Since 2021, BBVA México’s corporate governance system has been governed by the Group’s General Corporate Governance Policy, which aims to maintain coherent management in line with international standards of good governance, minimum requirements in terms of structure, composition, operation and diversity, as well as the parent-subsidiary relationship model.

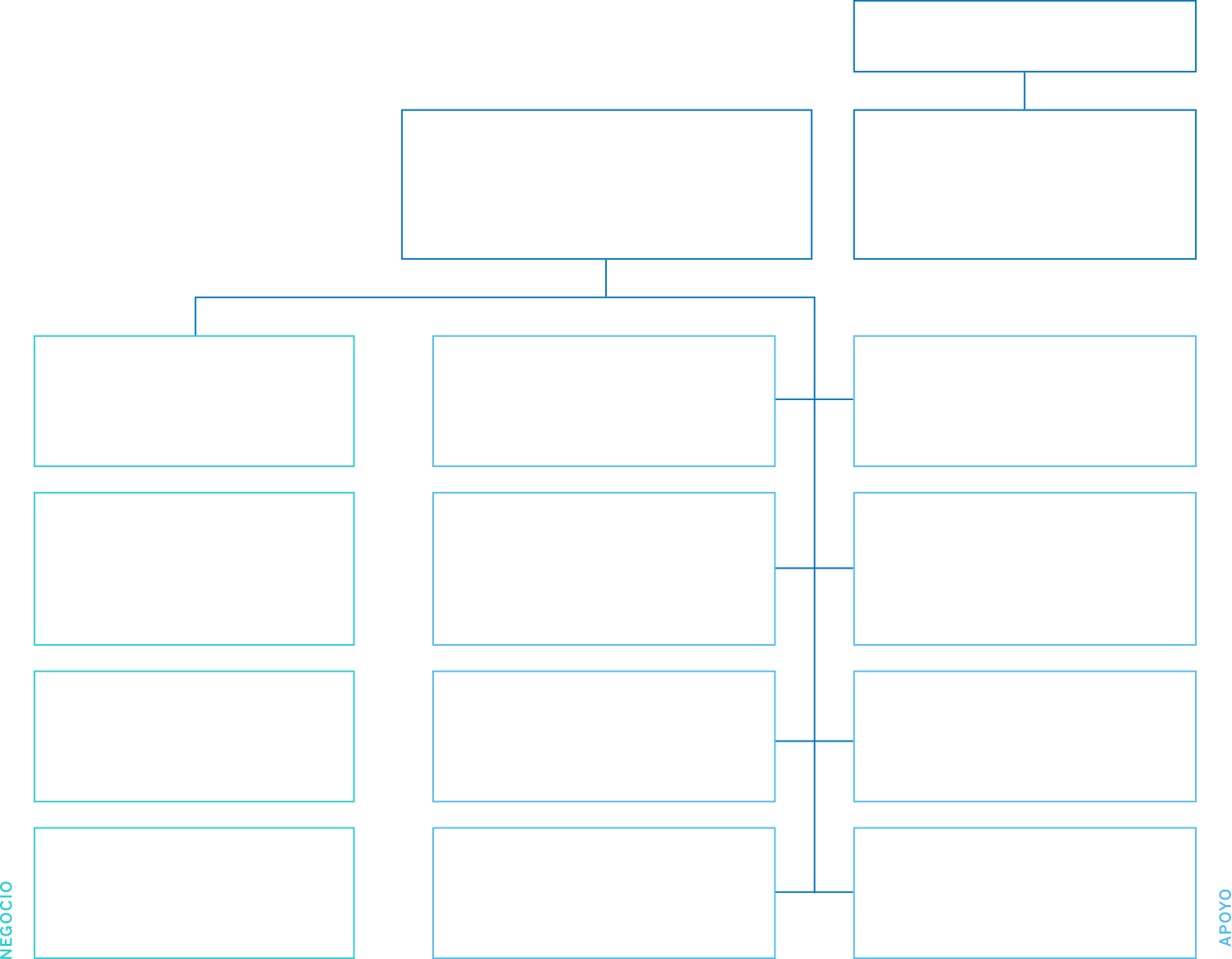

Corporate Structure of Grupo Financiero BBVA México

As of December 31, 2022

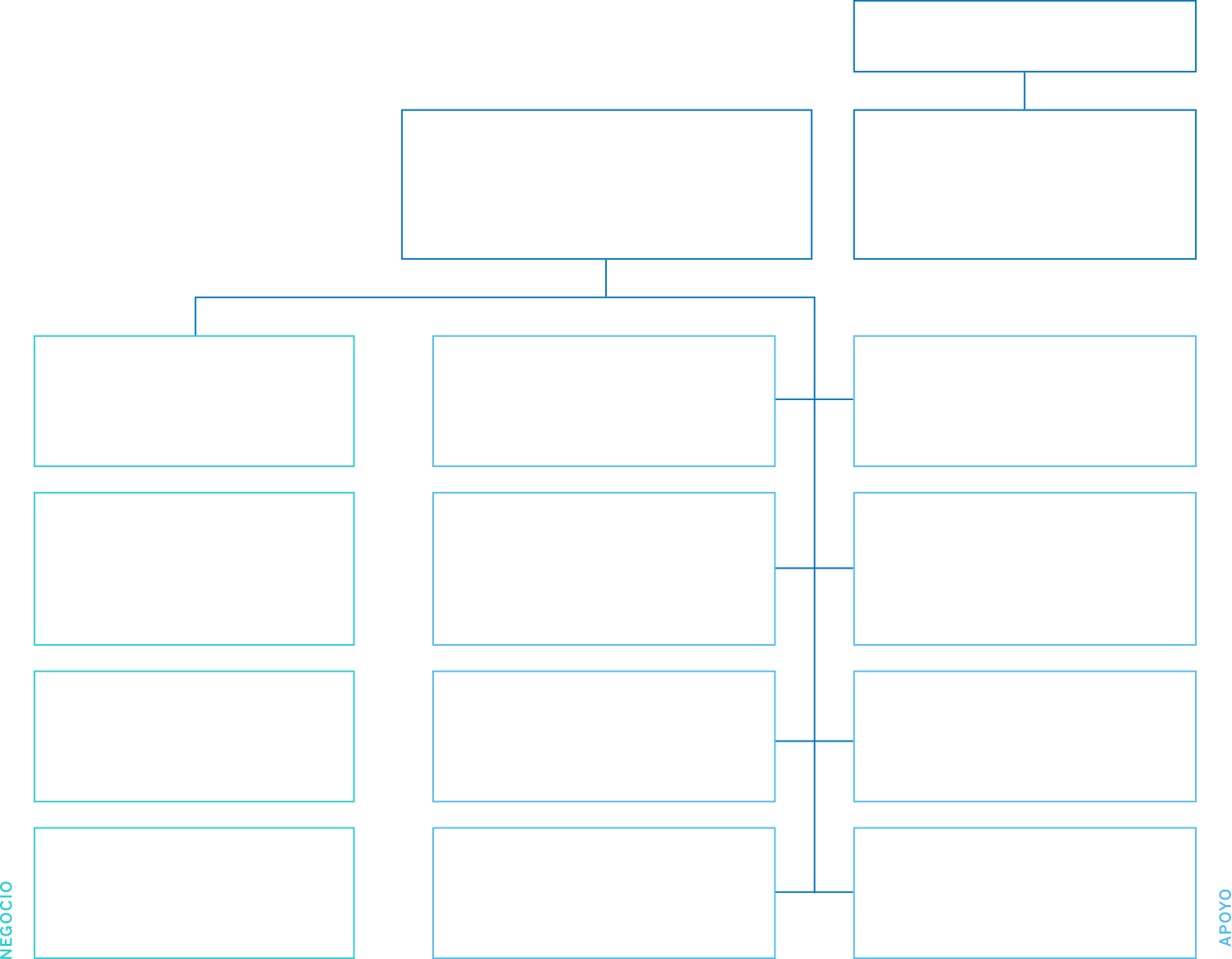

Management Structure

As of February 28, 2023

Board of Directors of BBVA México

Members and information as at 31 December 2022

The average tenure

of BBVA México directors

is 9.22 years.

Members

Jaime Serra Puche

Chairman of the Board

Seniority: 15 years

Eduardo Osuna Osuna

Vice Chairman of the Board

Seniority: 7 years

Onur Genc

Seniority: 4 years

Carlos Torres Vila

Seniority: 6 years

Vicente María Rodero Rodero

Seniority: 10 years

Carlos Vicente Salazar Lomelín*

Seniority: 17 years

Ricardo Guajardo Touché*

Seniority: 31 years

Jorge Saenz-Azcunaga Carranza

Seniority: 6 years

Cristina de Parias Halcón

Seniority: 3 years

Alternates

Alejandro Mariano Werner Wainfeld

Seniority: 1 year

Armado Garza Sada

Seniority: 4 years

Juan Asúa Madariaga

Seniority: 4 years

Fernando Gerardo Chico Pardo

Seniority: 13 years

Eduardo Javier Garza Fernández

Seniority: 4 years

Arturo Manuel Fernández Pérez*

Seniority: 28 years

Ana Laura Magaloni Kerpel*

Seniority: 1 year

Enrique de Jesús Zambrano Benítez

Seniority: 3 years

Alejandro Ramírez Magaña

Seniority: 9 years

*Independent member.

Sustainability governance

At BBVA, sustainability is a strategic priority. This means doing business at the same time as making a decisive contribution to solving the environmental and social problems of our times and creating opportunities for all. To this end, we have a Global Sustainability Office whose management model is replicated in Mexico and is operated by sustainability professionals located in the bank’s different business units.

This area is responsible for creating the strategic sustainable plan and coordinating the management of sustainability-related issues through various functions such as the development of sustainable and innovative products, the dissemination of specialized knowledge through differential advice to customers, and the establishment of marketing methodologies and relationships with strategic partners.

We have implemented this model as part of our Global Sustainability Policy, which has been approved by BBVA’s Board of Directors. As the highest supervisory body of the Bank, the Board of Directors will oversee the implementation of the Policy, either directly or through its Committees. This will be based on periodic or ad hoc reports received from the leader responsible for sustainability, the various areas of the Bank that will integrate sustainability into their day-to-day business and activities, and, if necessary, the heads of the different control functions within BBVA.

Non-financial risk management

Just as Grupo Financiero BBVA México is exposed to risks and opportunities on financial, regulatory, market and tax issues, it is also exposed to social, ethical and climate change-related risks, which could have adverse effects on customers, the business and communities should they materialize.

In this regard, there is a Corporate Policy for Non-Financial Risk Management which contains the guidelines and regulations for the management of operational risks inherent to the activities; this is in addition to the financial risk management and control model.

In accordance with this policy and with the support of the Business and Support Areas, the Non-Financial Risk Units and the Specialized Control Units, procedures and methodologies are developed to prioritize, assess and monitor potential risks on a regular basis, which allows for the implementation of appropriate mitigation and control measures.

Human Rights

As part of its commitment to human dignity and rights, Grupo Financiero BBVA México abides by the standards provided in the Universal Declaration of Human Rights, the United Nations Guiding Principles on Business and Human Rights and the Global Compact.

To this end, it strives to create a favorable environment that preserves well-being and contributes to the integral development of the societies where it operates, and for this, it generates sustainable actions that improve the well-being of these communities.

Respect for human rights and human freedoms is fostered and put into practice on a daily basis for employees, customers, suppliers, business partners and other stakeholders.

As part of the Grupo Financiero BBVA México’s efforts in this area, in 2022 a human rights due diligence process was carried out in line with the United Nations Guiding Principles on Business and Human Rights. With a preventive approach, the objective was to identify the possible impacts of operations on human rights and establish the necessary procedures to repair any damage in case of violation.

The following six topics for the prevention, mitigation and repair of impacts on human rights were evaluated:

The human rights due diligence process conducted by Grupo Financiero BBVA México evaluated the inherent and residual risks related to six issues with respect to its stakeholders, including employees, suppliers, customers and local communities. The results determined a medium-high effectiveness of the management and mitigation measures and allowed the detection of improvement opportunities and the establishment of action plans for strategy, disclosure and processes of Grupo Financiero BBVA México. With a preventive approach, the impacts of the transactions were evaluated and the appropriate procedures were identified to repair any damage in the event of a breach.

Code of Conduct

Grupo BBVA México, through its Board of Directors, approved the new Code of Conduct on March 23, 2022, which provides for the guidelines for action and ethical behavior expected of all those who make up the Group. This new Code of Conduct includes new sections that are adjusted to the current needs of the social environment, however, it still retains the essential fundamentals of the previous Code.

BBVA’s Code of Conduct represents an ethical commitment to its main stakeholders, as it seeks to promote principles of upright behavior throughout the organization, in order to maintain the highest standards of integrity and honesty. Strict standards of conduct are established for the development of Grupo BBVA México’s activities, focused on safeguarding customer information in accordance with legal provisions.

In order for everyone to know and become aware of the importance of the Code of Conduct, nearly 42 thousand Group employees were enrolled, of which by the end of 2022, 35,395 had been accredited, equivalent to 84% progress. The course will continue to be offered at Campus BBVA until we achieve the goal of having 100% of our employees complete the course, which is the target we have set for the end of the first quarter of 2023.

In May 2022, another significant milestone was reached, as the Emotional Support Hotline that Grupo BBVA México makes available to employees who need support in matters of Emergencies, Health, Domestic Violence, Harassment and Sexual Harassment was publicized.

The line is available 365 days a year, 24 hours a day, by calling 55 5621 - 4357 in Option 3, or from the corporate cell phone by dialing 814357. Throughout the year, this effort can be seen in different instances of the corporate buildings and is in a process of maturing.

In May 2022, as an additional effort to consolidate a culture of anti-corruption and conflict of interest prevention, we launched the Gift and Event Registration Tool, in which the Group’s employees must register:

Receiving gifts from third parties

Delivery of gifts from third parties

Events organized by BBVA, and

Attendance at third party events

Whistleblower Channel and Consultation Channel

The Whistleblower Channel and the Consultation Channel continue to be available to customers, suppliers and employees who wish to report any possible non-compliance with the Code of Conduct, regulations or unlawful practices. The channels are available 24/7, 365 days a year.

Anti-Money Laundering and Financing of Terrorist Activities

Grupo Financiero BBVA México commitment to Anti-Money Laundering (AML) and the financing of terrorism (FT) is a priority objective for the company.

Training of employees, members of the Board of Directors and Executives in AML and FT includes the disclosure of Know Your Customer policies, as well as the criteria, measures and procedures for due compliance with the applicable regulations; the dissemination of the provisions and their modifications. It also considers information on techniques, methods and trends to prevent, detect and report transactions that could be intended to favor, provide aid, assistance or cooperation of any kind for money laundering and terrorist financing.

Once the employee takes the course, he/she is accredited through the application of evaluations on the knowledge acquired.

|

AML and FT training |

|||

|---|---|---|---|

|

2020 |

2021 |

2022 |

|

|

Participants in AML training activities |

36,472 |

37,967 |

39,565 |

|

Specialists in activities on anti-money laundering and terrorist financing activities |

347 |

352 |

371 |

|

AML and TF Management Committee and Board of Directors |

31 |

31 |

31 |